Request your complimentary Personal Retirement Plan®.

As a California teacher, educator, or public employee, you may be wondering what retirement benefits are available to you.

The good news is that California educators and public employees are eligible to receive state benefits from the CalSTRS or CalPERS retirement systems and sometimes both. But oftentimes, the differences between the two are confusing, especially with important factors like eligibility requirements and how your benefits are calculated.

In this article, we’ll answer common questions about the two retirement systems and help you better understand how to maximize your retirement benefits.

The California State Teachers’ Retirement System (CalSTRS) and the California Public Employees’ Retirement System (CalPERS) manage pensions for California public school educators and other public employees. Depending upon your career, work history, employer, and position, you may be able to participate in both plans. Contact your employer to determine what type of pension is available to you. 1

For both CalSTRS and CalPERS, your retirement benefits are calculated according to this formula:

Service Credit x Age Factor x Final Compensation = Basic Retirement Benefit 1

Service Credit is your years of service and determined by years of employment as a CalSTRS and/or CalPERS member.

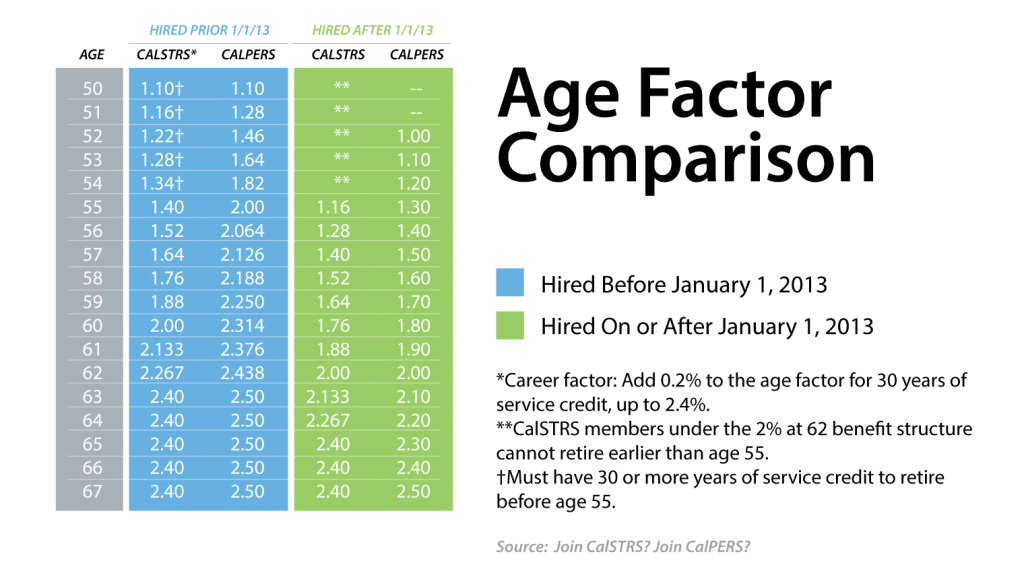

Age Factor is your retirement age and a multiplier that increases with age. Quite simply, the older you are when you retire, the more you’ll receive in retirement. This should incentivize you to work longer! Notably, to retire before age 55, you must have 30+ years of service credit. This differs between CalSTRS and CalPERS, AND if you were hired before or after January 1, 2013.

Final Compensation is how much you earned in your final year of full-time work.

With five years of service credit, CalSTRS participants can retire at age 55 and CalPERS participants at age 50. For each year beyond these minimums, your Age Factor multiplier increases. With more service credits, you will be able to retire with an Age Factor multiplier beyond the average for your age. 1

CalSTRS and CalPERS have different formulas for how your final compensation is determined.

Your final compensation depends on years of service credit for CalSTRS and is characterized by the highest average 12 or 26-month earnable compensation. Your final compensation depends on your employment contract or collective bargaining agreement for CalPERS and is based on the highest average 12 or 26-month full-time pay rate. 1

The pensions you receive through CalSTRS and CalPERS are meant to take the place of Social Security benefits. California educators do not participate in Social Security, but your pension may actually be worth more than the Social Security benefit.

On average, CalSTRS retirees collect 90% more than the equivalent Social Security recipient. In contrast, CalPERS retirees receive a pension up to five times greater than Social Security payouts for individuals with an equivalent working history and age. 2

To estimate how your pension may compare to a Social Security retirement benefit, use this Calculator .

As of June 30, 2021, the average monthly CalSTRS member-only benefit was $4,813 3 while for the 2020-2021 fiscal year CalPERS retirees received an average of $3,281 monthly. 4

CalSTRS pension benefits replace an average of 50% to 60% of members’ final salary in retirement. 5 This may not be enough to sustain how you envision living in retirement. To calculate how much you may receive, use the CalSTRS Benefits Calculator .

To learn more about if your pension will be enough and how to grow your benefits, contact a Financial Professional.

Each individual’s situation is unique. For personalized advice, talk to a Financial Professional today.

Sources:

Material presented is believed to be from a reliable sources and this website makes no representation as to its accuracy or completeness. This communication is not intended to be tax, legal, or accounting advice. Issues could exist that can affect the tax treatment of a transaction.

Securities and advisory services offered through PlanMember Securities Corporation. A registered broker/dealer, investment advisor, and member FINRA / SIPC

Before investing, carefully read the prospectus(es) or summary prospectus(es) which contain information about investment objectives, risks, charges, expenses, and other information all of which should be carefully considered. For current prospectus(es) call (800) 874-6910. Investing involves risk. The investment return and principal value will fluctuate and, when redeemed, the investment may be worth more or less than the original purchase price.

Asset allocation or the use of an investment advisor does not ensure a profit nor guarantee against loss.

6187 Carpinteria Ave. • Carpinteria, CA • 93013 • (800) 874-6910

© 2024 PlanMember Financial Corporation. All rights reserved.